Wealth Management

At Bee Beyonned, we offer personalized Wealth Management services designed to grow, protect, and optimize your wealth. Our expert team combines deep market knowledge with a client-first approach to help you achieve your financial goals with confidence. Trust us to navigate your financial future with wisdom and care.

Insurance

At Bee Beyonned, we provide comprehensive insurance solutions tailored to protect what matters most to you. From health and life to home and auto, our expert team is dedicated to ensuring your peace of mind by safeguarding your assets and loved ones. Trust us to be your partner in securing a brighter, more secure future.

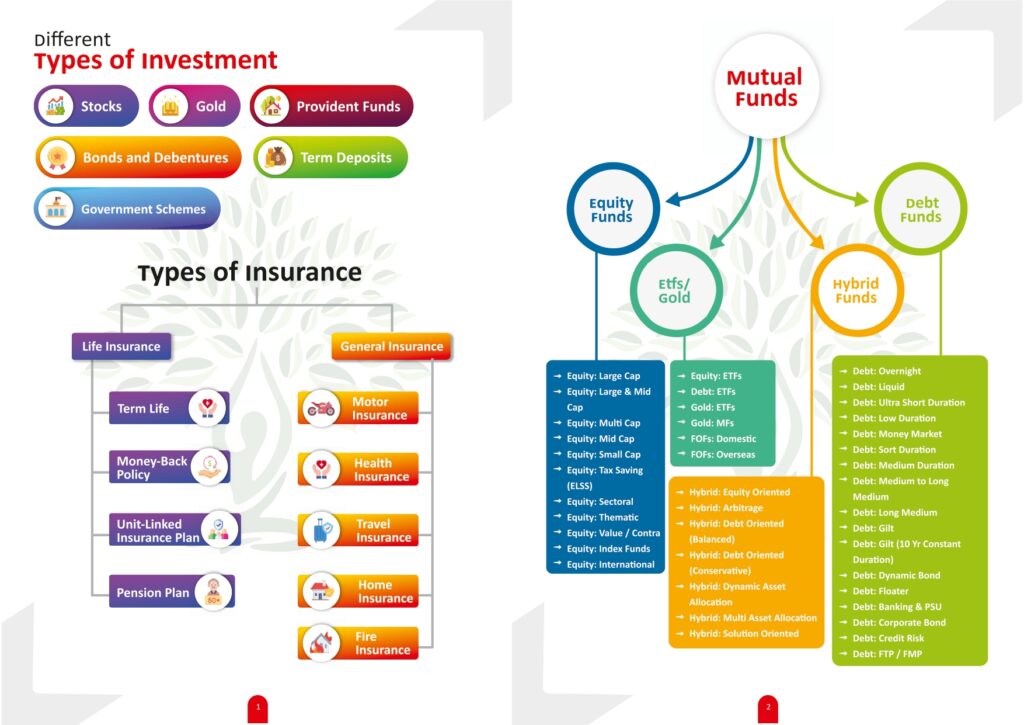

Investment

At Bee Beyonned, we empower you to make informed investment choices that maximize returns and secure your financial future. Our dedicated team provides tailored strategies and insights, ensuring your investments work as hard as you do. Invest with confidence and enjoy the wealth you deserve.

25+ Years Of experience

Bee Beyonnd Financial Services is a premier financial advisory firm dedicated to helping individuals and businesses navigate the complex world of finance with confidence and clarity. Our team of seasoned professionals brings a wealth of experience and a deep understanding of the financial landscape, enabling us to provide expert guidance and innovative solutions tailored to your unique needs. At Bee Beyonnd, we believe in building long-lasting relationships based on trust, integrity, and mutual respect. We are committed to maintaining the highest standards of confidentiality and transparency in all our interactions, ensuring that your financial information is secure and your best interests are always our top priority. Whether you are looking to optimize your investments, manage risks, plan for the future, or grow your business, Bee Beyonnd Financial Services is here to support you every step of the way. Our comprehensive range of services is designed to address all aspects of your financial life, providing you with the tools and strategies you need to achieve your financial goals and secure your future.

Financial Consulting

Bee Beyonnd financial consulting services are designed to provide you with expert advice on managing your finances effectively. We offer personalized solutions to help you achieve your financial goals and secure your future.

Risk Management

We help you identify, assess, & mitigate financial risks that could impact your business or personal finances. Our risk management strategies are tailored to safeguard your assets and ensure long-term stability.

Corporate Finance

We support your business growth initiatives with expert advice on capital raising, mergers & acquisitions, and financial structuring. Our corporate finance services are designed to help you make informed strategic decisions.

Tax Planning

Our tax planning services ensure that you remain compliant with tax regulations while optimizing your tax liabilities. We provide strategic advice on tax-efficient structures and practices to maximize your savings.

Insurance Planning

We offer comprehensive insurance planning services to protect you against unforeseen events. Our solutions include life insurance, health insurance, property insurance, and more, tailored to your specific needs.

Bond and Fixed Deposit (FD) Management

Our bond & FD management services provide you with stable and secure investment options. We help you select the best bonds and FDs to suit your risk profile and investment goals.

Retirement Planning

Retirement planning is about securing your financial future after your working years. It involves setting goals, saving, and investing wisely to ensure you can maintain your desired lifestyle. Key elements include assessing retirement needs, maximizing savings through retirement accounts, and choosing the right investment strategies. Planning early allows your money to grow over time, offering peace of mind and financial independence in your later years.

Child Education

Planning

Child education planning ensures that your children have the financial resources needed for their education. This involves estimating future education costs, setting up dedicated savings plans, and investing in tax-efficient plans. By starting early and investing consistently, you can ease the Bee Beyonnd financial burden of higher education and provide your children with opportunities for success.

Child marriage

Investing wisely can secure the funds needed for your child's marriage without financial strain. By starting early & choosing the right investment options, such as mutual funds, fixed deposits, or life insurance plans with a marriage benefit, you can grow your savings over time. These investments allow your money to compound, ensuring that when the time comes, you have a substantial amount set aside for wedding expenses, allowing you to fulfill your dreams.

Mutual Funds

We offer mutual fund advisory services to help you invest in a diversified portfolio of assets managed by professional fund managers. Our goal is to maximize your returns while minimizing risks.

Fixed Deposits

Our FD services provide you with safe and reliable investment options that offer guaranteed returns. We help you choose the best FDs based on your financial goals and risk tolerance.

Bonds

We provide expert advice on investing in bonds, ensuring a stable income stream and capital preservation. Our bond services include government bonds, corporate bonds, and municipal bonds.

Insurance

Our insurance services encompass a wide range of coverage options, including life, health, property, and casualty insurance. We help you select the best policies to protect your assets and loved ones.

PMS

Our PMS offers professional management of your investments tailored to meet your financial goals. It involves creating a customized portfolio with a focus on maximizing returns and managing risk, giving you access to expert strategies and market insights.

LAMF

LAMF (Loan Against Mutual Funds) allows investors to leverage their existing mutual fund holdings to secure a loan. It offers a way to access funds without liquidating investments, ideal for short-term liquidity needs.

AIF

AIFs (Alternative Investment Funds) provide opportunities to invest in non-traditional assets such as private equity, hedge funds, and real estate. They help diversify beyond conventional stocks and bonds for potentially higher returns.

Foreign Stocks

Bee Beyond Financial Services provides access to global markets, allowing investors to purchase stocks of international companies. Diversify risk and tap into growth opportunities outside the domestic market.

P2P Lending

This platform enables individuals to lend money directly to borrowers in exchange for interest, bypassing traditional financial institutions. P2P lending offers attractive returns and is an emerging alternative for lenders and borrowers.

Unlisted Shares

Investing in unlisted shares offers the opportunity to buy equity in companies that are not yet listed on stock exchanges. This early-stage investment strategy provides potential for significant returns as these companies grow and eventually go public.

- Customized Strategy: Tailored to individual financial goals and risk tolerance.

- Professional Management: Expert managers actively optimize portfolios.

- Diversification: Spread across assets to reduce risk and enhance returns.

- Transparency: Regular performance updates and clear reporting.

- Flexibility: Options for discretionary or non-discretionary management.

- Performance Tracking: Ongoing monitoring against benchmarks.

- Tax Efficiency: Strategic investments to minimize tax impact.

- Personalized Service: Dedicated support and portfolio adjustments as needed.

- Risk Management: Proactive identification and mitigation of potential risks to protect and preserve capital.

Explain to you how all this mistaken idea of denouncing pleasure and praising pain was born and I will give you a complete account of the system.

Our Mission

Our mission is to empower our clients with the knowledge, tools, and strategies to achieve financial success and security. We are dedicated to providing personalized, high-quality financial services that build long-term relationships based on trust and integrity.

Our Vision

Our vision is to be the most trusted and respected financial advisory firm, known for our unwavering commitment to client success, innovative solutions, and ethical practices.

Adviser

What sets Bee Beyonned apart is their personalized approach. They took the time to understand my financial goals, priorities, and concerns, crafting a tailored strategy that aligned perfectly with my needs.

Our Values

Integrity: We uphold the highest standards of honesty and transparency in all our interactions.

Confidentiality: We ensure that all client information is kept confidential and secure.

Client-Centric: We put our clients at the center of everything we do, providing personalized and attentive service.

Excellence: We strive for excellence in every aspect of our work, continuously improving our services.

Expertise: Our team comprises experienced professionals with deep knowledge in various financial domains.

Customized Solutions: We tailor our services to meet the unique needs and goals of each client.

Confidentiality: We prioritize the confidentiality of your financial information, ensuring that your data is secure.

Integrity: Honesty and transparency are at the core of our operations. We provide unbiased and truthful advice.

Comprehensive Services: We offer a wide range of financial services, ensuring all your financial needs are met under one roof.

I recently engaged with Bee Beyonned Financial Advisory Services, and I am thoroughly impressed with their expertise and dedication. From the very first consultation, their team demonstrated a deep understanding of my financial needs and goals. They provided comprehensive and personalized strategies that were easy to understand .

AYUSHI SINGH

Bee Beyonned Financial Advisory Services exceeded my expectations with their exceptional guidance and support. Their team of experts took the time to understand my unique financial situation and crafted a tailored plan that addressed all my concerns.

SIRAJ KHAN

Their advice was clear, actionable, and highly effective, leading to significant improvements in my financial health. The advisors are professional, approachable, and always available to answer any questions. I feel more confident and secure about my financial future thanks to their meticulous and personalized approach.

JYOTI PANDAY

We help you to see world differently , discover oppurtunities you may never have imagined.

Dr. Binal D Shah

+91-9833874201- 1 What is an investment?

- An investment refers to allocating money or resources into assets, such as stocks, bonds, real estate, or businesses, with the expectation of generating income or profit over time.

- 2 Why should I invest?

- Investing allows you to grow your wealth over time through capital appreciation, dividends, or interest. It also helps hedge against inflation and achieve long-term financial goals like retirement planning.

- 4 What is insurance?

- Insurance is a contractual agreement where an individual or entity (the insured) pays a premium to an insurance company (the insurer) in exchange for financial protection or reimbursement against specified risks or losses.

- 3 Why do I need insurance?

- Insurance provides financial security and protection against unexpected events that could otherwise lead to significant financial hardship. It helps mitigate risks associated with health, life, property, and liability.

We work with your company to identify position requirements, implement recruitment programs, and initiate employee assessments that maximize recruitment efforts

Tax Planning: A Simple Overview

Tax planning is the process of organizing your finances to minimize your tax liabilities.

Life Insurance: A Simple Guide

Life insurance is a financial safety net that provides money to your loved ones if you pass away.

The Ultimate Guide to Financial Consulting

Financial consulting involves providing expert advice and tailored strategies to help